Tuition or lesson fees (like kids’ music lessons, sports teams, or clubs).Subscription services (like Netflix, magazine subscriptions, or meal services).Utility bills (like electric, gas, water, and sewage).Insurance payments (like homeowner’s insurance, car insurance, or health insurance).Loan payments (like rent or a mortgage, car payment, or student loan).This includes anything we pay on a yearly, quarterly, or monthly basis. The next thing I wanted to have in our Budget Binder was a list of recurring expenses. Paying off those student loans will feel better than an extra meal out ever could! Tracking Recurring Expenses Then, for example, if we’re really tempted to go out to eat instead of just grabbing something from home, we think of our goal. If we’re looking at them each day or week when we’re tracking expenses in the binder, we renew our commitment and drive to reach them. These goals and action steps are in the front of the binder for a reason– they’re there as a constant reminder of what we’re working toward. However we decide to do it, it’s not enough to just set the goal. Or maybe we can cut down on our budget in other areas like clothing or eating out to come up with the extra cash. Maybe we can get an extra little side job to make some additional money to put toward the debt.

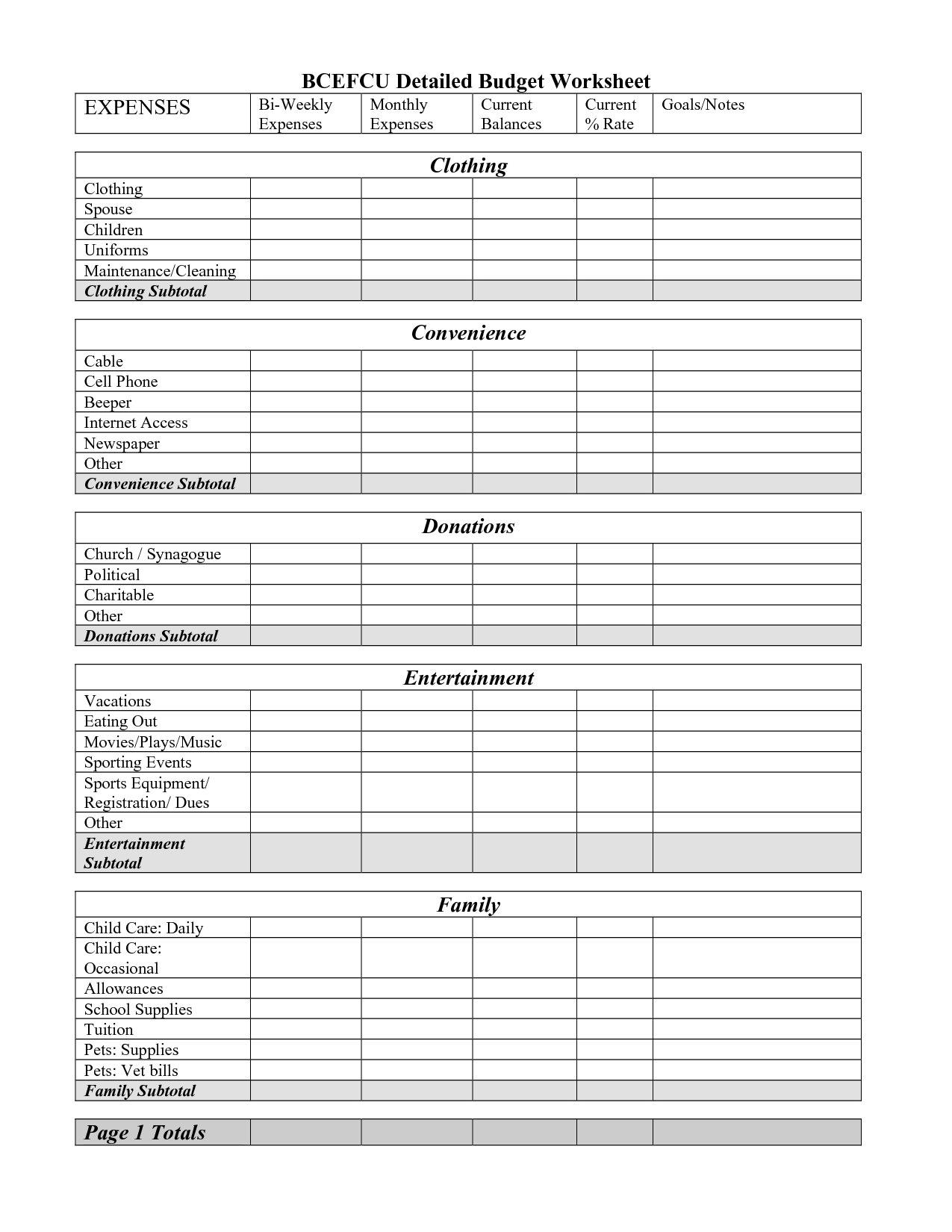

Maybe we’ll plan to make a double payment each month. We’ll write it down on this page, give ourselves a timeframe in which to complete it (by the end of December 2023), and then we’ll list the action steps that we are going to take in order to reach that goal. Let’s say we’ve set a goal to pay off our student loans in the next year. When Donnie and I take the time to sit down together and write out our financial goals, it puts us on the same page, and we are much more likely to achieve what we set out to do! Goal setting is oh-so-important to me, especially when it comes to finances. Monthly Check-in Page– This page helps you take a look over the previous month’s finances and gauge what you did well and what you would like to improve for the upcoming month.Pages to Track Variable Monthly Expenses– These sheets track expenses that vary some from month to month like grocery shopping, eating out, gas, clothing, etc.Pages to Track Recurring Expenses– These sheets track bills that stay pretty much the same each month like mortgage/rent, car payments, student loan payments, utility bills, etc.Goal Setting Sheet– Set financial goals for the year so you know exactly what you’re working toward.Cover Page– Keep track of your binder (and make it pretty so you want to use it often)!.(If you click on each of the links below, you can jump right to the explanation for that particular page.) Here’s what to include in a budget binder:

There are several key pages that I include in my budget binder each year.

0 kommentar(er)

0 kommentar(er)